How China uses the foreign exchange market as a strategy to control its own purchasing power

The People’s Republic of China has boosted the value of the yuan in the past through illicit trade tactics but is now actively depressing the yuan’s value. President Trump has attempted to label China as a currency manipulator and has promised retaliation. Yet, the Department of Treasury has not followed suit; in fact, the Treasury has said that it does not believe that China has met the criteria to qualify as a currency manipulator. The time to label China as an insidious currency market manipulator has passed.

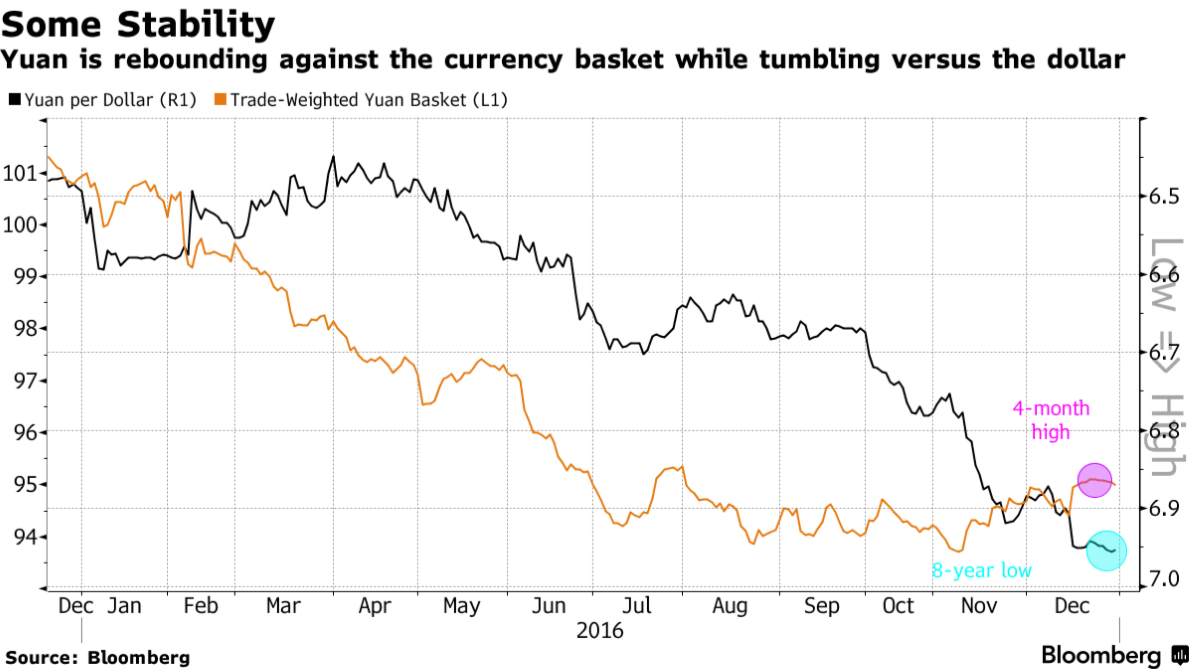

China has been dumping its foreign currency stockpiles to buy more yuan — trying to slow the currency’s fall.1 China accumulated almost $4 trillion of other currencies by mid-2014.1 Yet, the Chinese economy isn’t growing as much as it used to. In fact, several Chinese companies and individuals have outsourced investments — putting down pressure on the yuan.1 The more money leaving China, the more downward pressure on the Yuan (look at the 7% drop against the dollar in this year alone.1 In fact, China’s foreign currency assets dropped by $279 billion. Market forces may push the yuan price down faster.1

The Department of Treasury hasn’t accused China of currency manipulation since 1994.1 Department of Treasury puts countries on a currency blacklist when it suspects them of currency manipulation. Chinese manipulation of the yuan would result in Chinese products becoming cheaper on the American market and American products becoming more expensive on the Chinese market.1 Department of Treasury has looked to see if China “has spent equivalent of 2% of their economic output over a year buying foreign currencies in an attempt to drive those currencies up and their own currencies down.”1

Trump threatened to label China a currency manipulator and institute a 45% tariff on “imports of Chinese goods”.2 If anything, the United States should have labelled them a currency manipulator a long time ago. Not much would happen if the US declared China a currency manipulator. Year-long negotiations would have to occur.1 If the negotiations fail, the US could take smaller retaliatory actions like stopping U.S Overseas Private Investment Corp. (a government development agency — but the US already did this after the 1989 Tiananmen Square incident.) Labelling China a currency manipulator is “just a jaw-boning exercise”.1 At this point in time, it would be better to label China’s actions as “currency misalignment rather than manipulation.”6

The point of manipulating currencies is to “make exports more attractive and to gain market share in the United States.”2 Department of Treasury currency manipulation is comprised of three criteria: “has material trade surplus with the rest of the world, has a significant surplus with the United States,” and “has consistently intervened into foreign exchange markets to push currency in one direction.”2

China has manipulated other currencies before. Between 2000 and 2014, China “suppressed the rise of the renminbi to maintain a competitive advantage for its exports, adding $4 trillion to its foreign reserves over the period.”2 China did allow its currency to rise a little from 2005 to 2008.2 Chinese exports between 1999 and 2011 possibly cost 2.4 million American jobs and reduced individual worker earnings in America by $213 a year.2 According to economists, “when the [Chinese] financial crisis hit, it took the foot off the export pedal and deployed a giant fiscal stimulus, which bolstered internal demand.”2

The Chinese government has pushed the price of the yuan up.[3] Trumped has called China “the grand champion of currency manipulators.”3 Yet, China has seemed to have quit the tournament altogether. There are three specific quantitative criteria that the US Treasury used to evaluate currency manipulation: does the country run a sizeable surplus in American trade, does its current account-surplus exceed 3% of GDP, does it spend more than 2% a year to buy foreign assets to suppress value of currency.4 China only met the first criterion.5 If anything, China has raised the price of its currency against other currencies, not lowered it — demonstrating a diminutive distortion of the yuan’s value.3 Even the International Monetary Fund has asserted that the yuan is “no longer undervalued.”3 ■

-

-

Paul Wiseman, “Fact check: Does China manipulate its currency?,” PBS, December 29, 2016, https://www.pbs.org/newshour/world/fact-check-china-manipulate-currency (accessed November 4, 2017).

-

Eduardo Porter, “Trump Isn’t Wrong on China Currency Manipulation, Just Late,” NYTimes, April 11, 2017, https://www.nytimes.com/2017/04/11/business/economy/trump-china-currency-manipulation-trade.html (accessed November 4, 2017).

-

“China and currency manipulation,” The Economist, March 2, 2017, https://www.economist.com/news/finance-and-economics/21717997-government-has-been-pushing-price-yuan-up-not-down-china-and (accessed November 4, 2017).

-

Wayne Morrison and Marc Labonte, “China’s Currency Policy: An Analysis of the Economic Issue,” July 22, 2013, https://fas.org/sgp/crs/row/RS21625.pdf (accessed November 4, 2017).

-

Xiangron Yu, Huili Chang, and Hong Liang, “China Macro Thematic Report: History of ‘currency manipulation,’ and challenges facing China,” China International Capital Corporation, December 20, 2016, http://www.cicc.com/portal/business/rs/investweather///1482223027553F305043F2F436270244FD1426722690B.pdf (accessed November 4, 2017).

-

Elizabeth Pettis, “Is China’s Manipulation of Its Currency an Actionable Violation of the IMF and/or the WTO Agreements,” The Journal of International Business and Law (2011), http://scholarlycommons.law.hofstra.edu/cgi/viewcontent.cgi?article=1170&context=jibl (accessed November 4, 2017).

-